Work

10+ years of experience in applied economics & data analysis and 5+ years of experience in finance.

Moody's Investors Service New York, NY, USA

VP Sr. Financial Engineer Jan 2022 - Present

PwC New York, NY, USA

Senior Associate/Data Scientist Jan 2020 - Jan 2022

Roberts Capital Advisors, LLC New York, NY, USA

Senior Economist/Economist Oct 2015 - Jan 2020

Financial Analyst/Data Analyst Oct 2015 - Jan 2020

Euromoney Country Risk Online/Remote

Expert Panel Contributor Dec 2017 - Jan 2020

University of Canberra Online/Remote

Adjunct Associate Professor Sep 2015 - Aug 2021

Xi'an Jiaotong-Liverpool University Suzhou, Jiangsu, P. R. China

Lecturer Aug 2012 - Sep 2015

National University of Singapore Singapore, Singapore

Visiting Fellow Jul 2010 - Jul 2012

Brown University Providence, RI, USA

Research Assistant Sep 2008 - May 2009

World Bank Washington, DC, USA

Short-term Consultant Summer 2007

Brown University Providence, RI, USA

Teaching Fellow Sep 2006 - Dec 2008

Fincor S.A. Lisbon, Portugal

Junior Financial Analyst Jul 2001 - Jul 2002

Skills

Economics - Coding - Finance - Languages

Brown University Providence, RI, USA

PhD in Economics Sep 2004 - May 2011

The University of Birmingham Birmingham, UK

MSc in Economics with distinction Oct 2002 - Oct 2003

Universidade Nova de Lisboa Lisbon, Portugal

Licenciatura (BSc) in Economics Sep 1997 - Jun 2001

Coding Skills Python (Scikit Learn, iGraph, Pandas, NumPy, Flask, Seaborn), SQL, R, Stata , EViews, Matlab, VBA/Excel

Technologies Git, Docker, Sprint Framework, Azure, AWS, GIS, RESTful APIs

Project Management Agile/Professional Product Owner and Scrum Master

Finance CFA candidate, Reuters EIKON 3, FactSet Terminal, Bloomberg Terminal

Foreign Languages Portuguese, Spanish, French (Intermediate), Mandarin (Beginner)

|

|

|

|

|

|

|---|

Blog

Views on the economy

| 05/16/2020 07:30 PM | |

| Natural Disasters (and Pandemics), Man Made Disasters (and Lockdowns) and Economic Growth | |

|

As the COVID-19 pandemic spread to Europe in early 2020, most countries decided to establish a lockdown, with one notable exception - Sweden. This was followed with a large public debate, usually on social media, on the benefits and costs of the lockdown. This discussion focuses on two points: (1) the human cost - is the lockdown efficient in reducing the loss of lives?; (2) the economic cost - Are the lockdowns condemning a generation to poverty? are we exchanging a natural disaster (a pandemic) for a man made disaster (lockdowns)? While I defer the discussion regarding the first point to epidemiologists and other public health experts, my research on the impacts of the 2004 Indian Ocean Tsunami has lead me to examine the literature on the impact of natural disasters (including pandemics), and man made disasters on economic growth. The short answer is: No - lockdowns are not condemning a generation to poverty. Lockdowns are likely to have larger short term economic costs than the actual pandemic, yet, regardless of the path taken, economies will recover to their previous growth path, with no long term impact on poverty or literacy. Before I start I should distinguish between two different time horizons: (a) short term, and (b) long term. Take the year-over-year growth rate of real GDP for the US in the graph below. The blue line is the quarterly GDP numbers released by the Bureau of Economic Analysis that varies depending on the season (economic activity is higher during the summer than during winter), depending on the economic cycle (booming years like the 1960's saw a higher economic activity than recession years like the 2009 Great Recession) and the trend - the red line. We can think of long term economic growth as the trend, which is what determines GDP in 20 years or more, and short term GDP as all the other factors (seasonality and cyclicality) of GDP, what makes the official GDP numbers vary around the trend.

Economic literature is clear on the impact of natural and man made disasters on long term economic growth - there is no negative impact only some potential positive impacts. For instance, David and Weinstein (2002) found that the atomic bombings of Hiroshima and Nagasaki had only temporary impact on the development of those cities. Miguel and Roland (2011) found that the US bombing of Vietnam had no long term impact on poverty rates, literacy rates or consumption. Skidmore and Toya (2002) show that repeated climate disasters have a positive impact on long-term economic growth, through greater innovation, though the impact is lower of geological disasters. More specifically, in a recent review of the literature Garret (2008) states that the 1918 Spanish Influenza had mostly short term impacts. Are we exchanging a natural disaster for a man made disaster on long term growth? There is no reason to believe that either the lockdown or the pandemic will have long lasting impacts in long term economic growth. 10 years from now Sweden will not be further head of its European counterparts that decided to lockdown. This is in line most economic research on growth that build on the Ramsey/Solow-Sawn growth model that attributes long-term economic growth to technological progress. The short term impact of pandemics and lockdowns on economic growth are harder to measure. Eichenbaum, Rebelo and Trabandt (2020) develop a model that incorporates epidemiology into the standard economic model. The authors argue that pandemics lead to slower economic growth as people reduce consumption and work to avoid getting infected. They further argue that there is a case for government intervention as individuals do not bear the entire cost of their actions (infecting other people). However, lockdowns make recessions worse thought they save lives. These findings are based on economic models since there is little empirical evidence, since the 1918 pandemic pre-dates the systematic collection of economic data. What is worse for economic growth - the pandemic or the lockdown? The pandemic is likely to lead to a recession - a lockdown is likely to make it worse (by an unknown amount) while saving lives - however, whatever the path taken, in 10 years from now economies will recover and neither choice will likely lead to a larger benefit in terms of economic growth, poverty and literacy rates. The views expressed in this post are my own and do not represent the views of my current or past employers. |

|

| 06/01/2019 03:32 PM | |

| The U.S. Federal Debt - How big is too big? | |

|

The Federal debt has risen on average +8.5% each year over the last 52 years, from $320bn in the beginning of 1966 to $22tn at the end of 2018. At the same time, national income, as measured by nominal Gross Domestic Product (GDP) has increased on average only +6.4% per year. As the Federal debt increased at a faster pace than GDP the debt to GDP ratio has increased from 40.3% in 1966 to 105.3% in 2018. Policy makers and economists alike have become concerned regarding the debt level. Is the current debt level sustainable? Historically low interest rates make the direct cost of the U.S. Federal debt, the interest payments on the debt, far from their historical maximums. Interest payments depend not only on the size of debt but also on interest rates. Since the 1980’s interest rates on the 10-year Treasury bonds have declined from a maximum of 15.15% in 1981 to 2.53% in 2019. As a result, interest payments on the current Federal debt has declined from a maximum of 5.0% in 1995 to 3.2% in 2019. We must not forget the indirect costs of the U.S. Federal debt. There are several channels through which high U.S. Federal debt could adversely impact medium- and long-run growth which have received attention in the economics literature. High public debt can adversely affect capital accumulation and growth via higher long-term interest rates, higher future taxation, inflation, and greater uncertainty regarding economic policies and prospects. In more extreme cases of a debt crisis, by triggering a banking or currency crisis, these effects can be magnified. High debt is also likely to constrain the scope for stabilization policies during recessions, which may result in higher volatility in terms of GDP growth, inflation and employment and further lower growth. Today U.S. real GDP growth is on average 1.3 percentage points lower, relative to 1966 due to the increase in the debt-to-GDP ratio. In general, the estimated impact of the U.S. Federal debt on growth is small, with a 10 percentage points increase in the initial debt-to-GDP ratio leading to 20 basis points slowdown in annual real per capita GDP growth . This implies that the U.S. economy could have grown at 4.2% in 2018 instead of the 2.9% recorded at the end of the year, if the debt-to-GDP level had remained at its 1966 level. A large number of empirical papers find that the relationship between debt and growth is non-linear and characterized by the presence of a threshold, around 90 to 100 of debt-to-GDP, above which debt starts having a larger negative effect on economic growth. However, the negative relationship between debt and growth and the classic 90 percent threshold are not robust across samples, specifications, and estimation techniques. In particular, there is evidence that the effect of debt depends on the quality of institutions and that its negative effect is confined to non-democratic developing countries and economies in which the majority of debt-holders are non-resident. It is not clear whether a debt overhang argument can be easily applied to the U.S. economy. In conclusion, the cost of the Federal debt in terms of real GDP growth could already be large and the U.S. economy could benefit from a reduction in Federal debt. However, it is unlikely that U.S. economic growth will collapse if it passed a certain critical level of debt-to-GDP. |

|

| 10/22/2014 10:02 PM | |

| Wage Subsidies and the Labor Supply of Older People: Evidence from Singapore's Workfare Income Supplement Scheme | |

|

I currently completed and submitted to a journal a paper on the labour supply impact of a wage subsidy program for older workers. In particular, I looked at the impact of the Workfare Income Supplement Scheme in Singapore and found that the program increased the labour supply of women age 60 to 64 by 3.3 and 5.4 percentage points. This is the same paper I presented at the Asian Pacific Economies Seminar in May. You can find the paper on SSRN. |

|

| 09/14/2014 01:43 AM | |

| Using Wikipedia to enhance student learning: A case study in economics | |

|

I have completed and uploaded on SSRN a new version of my joint paper with JingPing Li on using Wikipedia in teaching economics.

|

|

| 09/14/2014 01:40 AM | |

| Rural-Urban Migration and the Skill Wage Premium in Brazil: 1980-2000 | |

|

I have uploaded a new version of my paper on rural-urban migration and the skill wage premium in Brazil. It is available on SSRN

|

|

Publications

Labor Economics, Regional Economics and the Macroeconomy.

Healthy food diversity and supermarket interventions: Evidence from the Seacroft Intervention Study

with Simon Rudkin, 2019

Volunteerism after the Tsunami: The Effects of Democratization

with Ari Kuncoro and J. Vernon Henderson, 2017

Working Papers

Work in progress

Supermarkets and the Demand for Healthy Food: A Quasi-Natural Experiment (with Simon Rudkin) 75%

Quantifying the effect of active learning in business schools: evidence from a flipped classroom experiment (with Haifeng Fu and Liting Zhang) 30%

Maids and school teachers: Low skill migration and high skill labor supply 75%

The Impact of Migration on the Gender Wage Gap 50%

Behind every successful man is a great women (with Haoming Liu) 20%

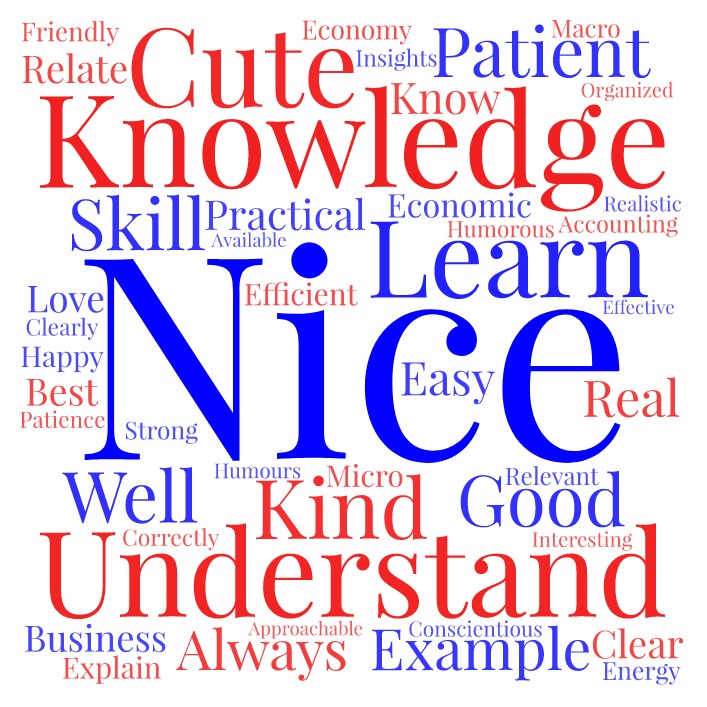

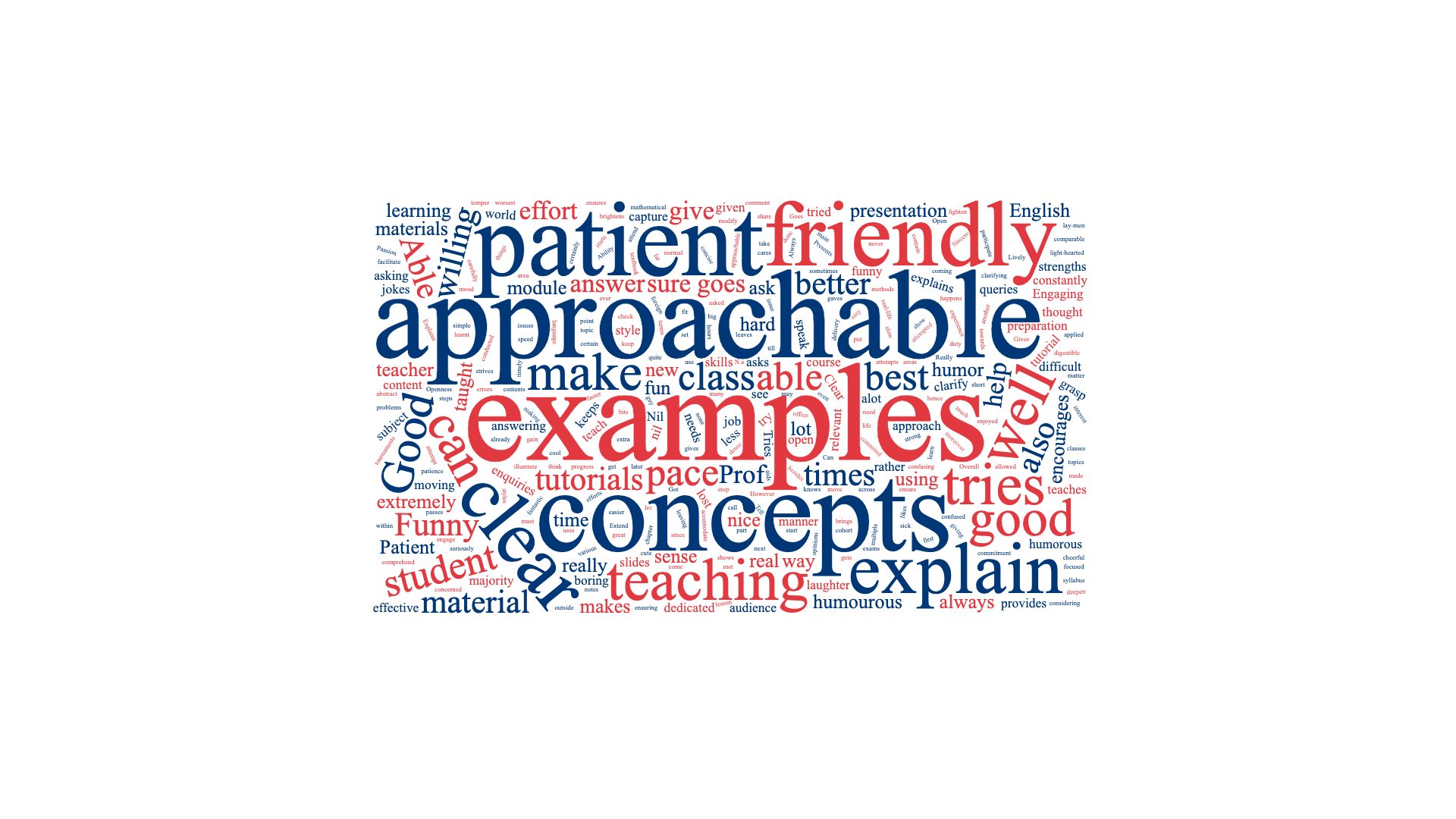

Teaching

Helping people grow.

I am a member of the Higher Education Academy in the U.K. and have a Certificate of Professional Studies in Learning and Teaching in Higher Education from the University of Liverpool and completed the Professional Development Programme from the Centre for Development of Teaching and Learning at the National University of Singapore as well as Certificates in Teaching from the Sheridan Center for Teaching and Learning Brown University.

While at the International Business School Suzhou at Xi'an Jiaotong-Liverpool University I won the Dean's Award for Outstanding Contribution to Learning and Teaching.

You can download a paper version of my portfolio here.

Hobbies

Healthy body, healthy mind

Running, reading, and photography